Abstract

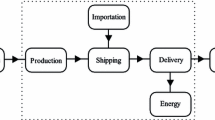

The Brazilian natural gas sector is currently characterized by low maturity and dynamism of the market. The stochastic behavior of the demand for natural gas added to its associated market price volatility motivates the usage of underground storage to provide supply flexibility and protection against price fluctuations. However, the existing literature lacks a proper analytical tool to assess the benefits of underground natural gas storage (UNGS) activity. In this work, it is proposed a stochastic dynamic programming model for long/medium-term operation planning to determine the optimal gas supply and storage policies. A markovian model characterizes the uncertainty over the thermoelectric demand and market price. The proposed model is efficiently solved using the stochastic dual dynamic programming algorithm for the Brazilian case study considering realistic data for the actual gas network and electric power system. For an exogenous but meaningful choice of underground storage location and size, it is observed the operational and economic benefits of the provided storage flexibility. Finally, our numerical simulations show that the economic benefit for the system surpasses the operational and capital expenses for the storage infrastructure in depleted fields and salt caverns.

Similar content being viewed by others

Notes

When gas is withdrawn (injected) from (at) the storage, the stock is emptied (filled) into an upper (lower) amount than the one actually delivered (withdrawn) to the system \({\varvec{w}}_{r,t}\) (\({\varvec{y}}_{r, t}\)), since part of the gas is consumed in the compressors (Martins 2012).

Although \({\varvec{f}}^{\mathrm{TO}}_{l,t}\) and \({\varvec{f}}^{\mathrm{FROM}}_{m,t}\) have been created to simplify the notation of the model, relating all incoming and outgoing gas flow, respectively, the primary variable is \(f_{m,l,t}\).

For a better understanding, the SDDP algorithm used is presented in Dowson (2018).

By 2015, about 80% of the total imported LNG volume was purchased on the spot market.

This price excludes ICMS and PIS/COFINS taxes, transmission and distribution margin.

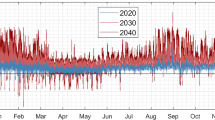

After June 2021, the expected expansion of the Brazilian power system comprises an increased demand of gas-based thermoelectric plants in the Northeast subsystem.

OPEX are the expenses a company incurs for running their day-to-day operations.

CAPEX are purchases of significant goods or services designed to improve a company’s performance in the future.

Given that variable operating costs are incorporated into the model as stocking cost, OPEX took into account the fixed operating costs presented in the previous chapter.

To annualize the cost of capital investment, a 30-year amortization period was considered, which is reasonable for capital intensive investments in infrastructure.

References

Almeida JRUC, De Almeida ELF, Torres EA, Freires FGM (2018) Economic value of underground natural gas storage for the Brazilian power sector. Energy Policy 121:488–497

Alonso-Ayuso A, Escudero LF, Guignard M, Weintraub A (2018) Risk management for forestry planning under uncertainty in demand and prices. Eur J Oper Res 267(3):1051–1074

ANP (2017) Anuário estatístico brasileiro do petróleo, gás natural e biocombustíveis: 2017. Tech. rep. National Petroleum, Natural Gas and Biofuels Agency, Brazil

Bäuerle N, Riess V (2016) Gas storage valuation with regime switching. Energy Syst 7(3):499–528

Benquey R, Lecarpentier A (2010) Underground gas storage in the world. CEDIGAZ

BraziL (2019) Termo de compromisso e cessação de prática. http://www.cade.gov.br/noticias/cade-e-petrobras-celebram-acordo-para-venda-de-refinarias-de-petroleo/tcc-cade-petrobras.pdf

Bruno S, Ahmed S, Shapiro A, Street A (2016) Risk neutral and risk averse approaches to multistage renewable investment planning under uncertainty. Eur J Oper Res 250(3):979–989

Carmona R, Ludkovski M (2010) Valuation of energy storage: an optimal switching approach. Quant Finance 10(4):359–374

CCEE (2018) Resultados do newave. http://www.ccee.org.br/portal/faces/pages_publico/o-que-fazemos/como_ccee_atua/precos

CEPEL MN (2013) Modelo estratégico de geração hidrotérmica a subsistemas equivalentes. Manual do Usuário Versão 14(1)

Dowson O (2018) Applying stochastic optimisation to the new zealand dairy industry. PhD thesis, University of Auckland

Dowson O, Kapelevich L (2017) SDDP.jl: a Julia package for stochastic dual dynamic programming. Optimization. http://www.optimization-online.org/DB_FILE/2017/12/6388.pdf

Dunning I, Huchette J, Lubin M (2017) Jump: a modeling language for mathematical optimization. SIAM Rev 59(2):295–320. https://doi.org/10.1137/15M1020575

EPE (2017) Plano decenal de expansão. Empresa de Pesquisa Energética, Brasília

Goraieb C, Iyomasa W, Appi C (2005) Estocagem subterrânea de gás natural: tecnologia para suporte ao crescimento do setor de gás natural no brasil. IPT-Institute of Technological Research of São Paulo, São Paulo

Hageman JA, van den Berg RA, Westerhuis JA, van der Werf MJ, Smilde AK (2008) Genetic algorithm based two-mode clustering of metabolomics data. Metabolomics 4(2):141–149

Katz DL, Tek MR et al (1981) Overview on underground storage of natural gas. J Petrol Technol 33(06):943–951

Lai G, Margot F, Secomandi N (2010) An approximate dynamic programming approach to benchmark practice-based heuristics for natural gas storage valuation. Oper Res 58(3):564–582

MacQueen J et al (1967) Some methods for classification and analysis of multivariate observations. In: Proceedings of the fifth Berkeley symposium on mathematical statistics and probability, Oakland, vol 1, pp 281–297

Martins L (2012) Dimensionamento de uma estocagem de gás natural sob incerteza de demanda e preço de gnl. PhD thesis, PUC-Rio

MME (2017) Boletim mensal de acompanhamento da indústria de gás natural. Tech. rep, Ministry of Mines and Energy, Brazil

Nogueira D (2007) Diplomacia do gás: a petrobras na política externa de cardoso para a integração energética com a bolívia (1995–2002). PUC/RJ, Rio de Janeiro

Pereira M, Pinto L (1985) Stochastic optimization of a multireservoir hydroelectric system: a decomposition approach. Water Resour Res 21(6):779–792

Philpott AB, De Matos VL (2012) Dynamic sampling algorithms for multi-stage stochastic programs with risk aversion. Eur J Oper Res 218(2):470–483

Resende L, Almeida E, Almeida JR, Cunha P, Torres E, Valladão D (2018) Estocagem subterrânea de gás natural no brasil: desafios e oportunidades de mercado. In: Rio oil & gas expo and conference

Rockafellar RT, Uryasev S (2002) Conditional value-at-risk for general loss distributions. J Bank Finance 26(7):1443–1471

Rockafellar RT, Uryasev S et al (2000) Optimization of conditional value-at-risk. J Risk 2:21–42

Shapiro A (2011) Analysis of stochastic dual dynamic programming method. Eur J Oper Res 209(1):63–72

Shapiro A, Tekaya W, da Costa JP, Soares MP (2013a) Risk neutral and risk averse stochastic dual dynamic programming method. Eur J Oper Res 224(2):375–391

Shapiro A, Tekaya W, Soares MP, da Costa JP (2013b) Worst-case-expectation approach to optimization under uncertainty. Oper Res 61(6):1435–1449

Tek MR (2012) Underground storage of natural gas: theory and practice, vol 171. Springer Science & Business Media

Valladão D, Silva T, Poggi M (2019) Time-consistent risk-constrained dynamic portfolio optimization with transactional costs and time-dependent returns. Ann Oper Res 282(1):379–405

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Resende, L.d.O., Valladão, D., Bezerra, B.V. et al. Assessing the value of natural gas underground storage in the Brazilian system via stochastic dual dynamic programming. TOP 29, 106–124 (2021). https://doi.org/10.1007/s11750-020-00575-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11750-020-00575-w

Keywords

- Underground storage of natural gas

- Natural gas supply chain

- Stochastic dual dynamic programming

- Brazilian natural gas sector